-

KEA BUILDER

Build Funnel & WebsiteKeabuilder

FUNNEL BUILDER

Build Funnel & Variation in a matter of hours without single knowledge of coding or strategic skills.

WEBSITE BUILDER

Build a impressive one page site or a multistep site with a blend of virtual office and blogging enriched with SEO and analytics.

-

Features

Build Shop & CoursesFeatures

Memberships

Effortlessly create and manage subscription-based content with Kea's all-in-one Memberships feature.

CRM

Streamline relationships with Kea's CRM, featuring automation, insights, and personalized engagement.

Sales

Boost revenue with Kea’s Sales tools for efficient tracking, lead management, and deal closing.

Communication

Enhance engagement with Kea's Communication tools for seamless email, chat, and more.

Scrumboard

Efficiently manage projects with Kea's intuitive Scrumboard, enhancing task tracking and team productivity.

Advance Analytics

Unlock business insights with Kea's Advanced Analytics for real-time data and actionable metrics.

Domain

With Kea's easy domain setup and control, manage your online presence.

Project Management

Streamline your workflow with Kea's efficient Project Management tools.

-

Market Place

Hire The Best TalentMarket Place

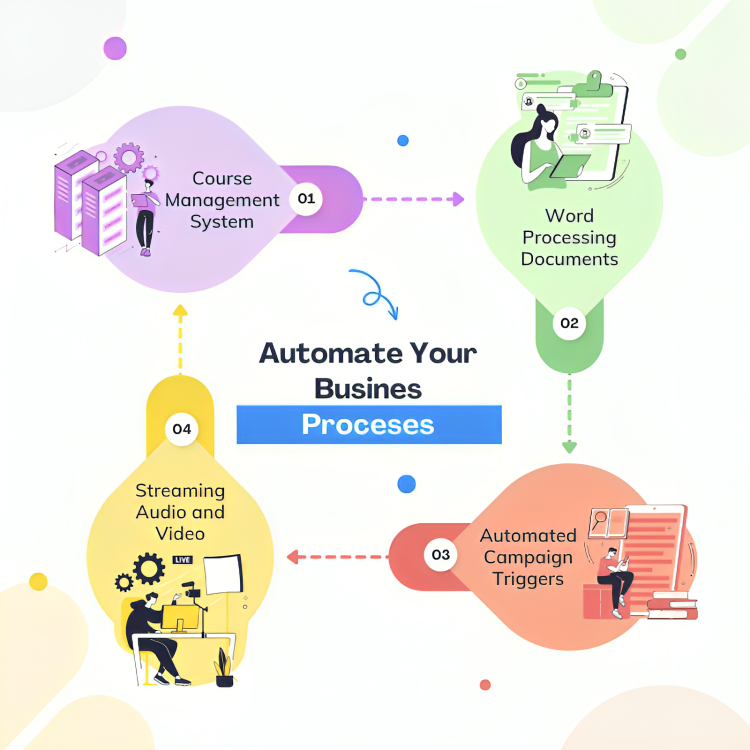

Automation

Find top experts to automate tasks and enhance productivity.

Digital Marketing

Boost your online presence with our experts, for your growth and engagement.

Virtual Assistance

Get smart support for your tasks with our Virtual Assistance.

Kea Certified Experts

Get expert guidance from Kea Certified Experts for guaranteed success.

-

Resources

360 Degree SupportResources

Help docs and videos

Explore Help Docs and Videos to navigate Kea’s features and optimize your use.

Blogs

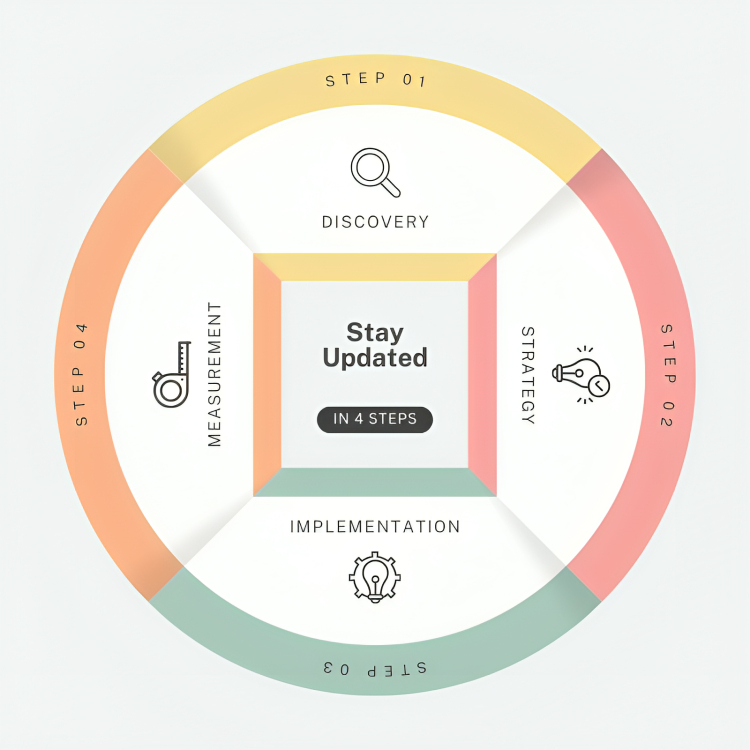

Stay updated with our industry Blogs for valuable insights and trends.

Kea support

Get expert assistance with Kea Support for all your platform-related queries and issues.

-

Pricing

Get Started with $1Pricing

Beta

Perfect for small business to getting started.

Startup

Comprehensive tools tailored Approach for scaling your business beyond the lines.

Entrepreneur

Manage more complex workload.

-

News & Events

Upcoming Information -

Sign Up